I’d like to provide you with an interesting project, Moola Market (Moola) – As you may know, Decentralized Finance (DeFi) has been growing recently, thanks in part to the development of lending & borrowing platforms, or banking in DeFi by bringing together those with excess capital and those in need of funds.

What is Moola Market? #

Moola is a non-custodial liquidity protocol for Lending & Borrowing built on the Celo blockchain that democratizes yield and credit access.

Moola Market’s home page.

In February 2021, Moula launched its public beta version of its web app. The depositors get interest, which is repaid by the borrowers, who can take out over-collateralized loans in perpetuity or under-collateralized flash loans. With Moola, you can get loans even without collateral.

How does Moola work? #

- Moola’s vision is to become the go-to lending & borrowing platform in the Celo Ecosystem. To do that, Moola’s architecture draws inspiration from leading platforms like Aave, and Compound.

- Moola is safe for both depositors and borrowers. Whenever there is little liquidity, borrowers are more likely to pay back their loans, and depositors are motivated to deposit additional money.

- For Savers: Their operation is a Liquidity Pool of Assets (LP) where lenders (savers) deposit cryptocurrencies into liquidity pools to receive interest.

- Borrowers join the pool to find assets to borrow in exchange for being collateralized by one of Moola’s assets. There are no time restrictions on deposits with Moola. You can initiate a withdrawal at anytime.

Borrowers can borrow up to 75% of the value of any asset they own, which means that property worth $100 is required to get a loan of $75. Leading platforms like MarkerDAO, Compound, and Aave have collateral ratios of 67%, 75%, and 75%, respectively.

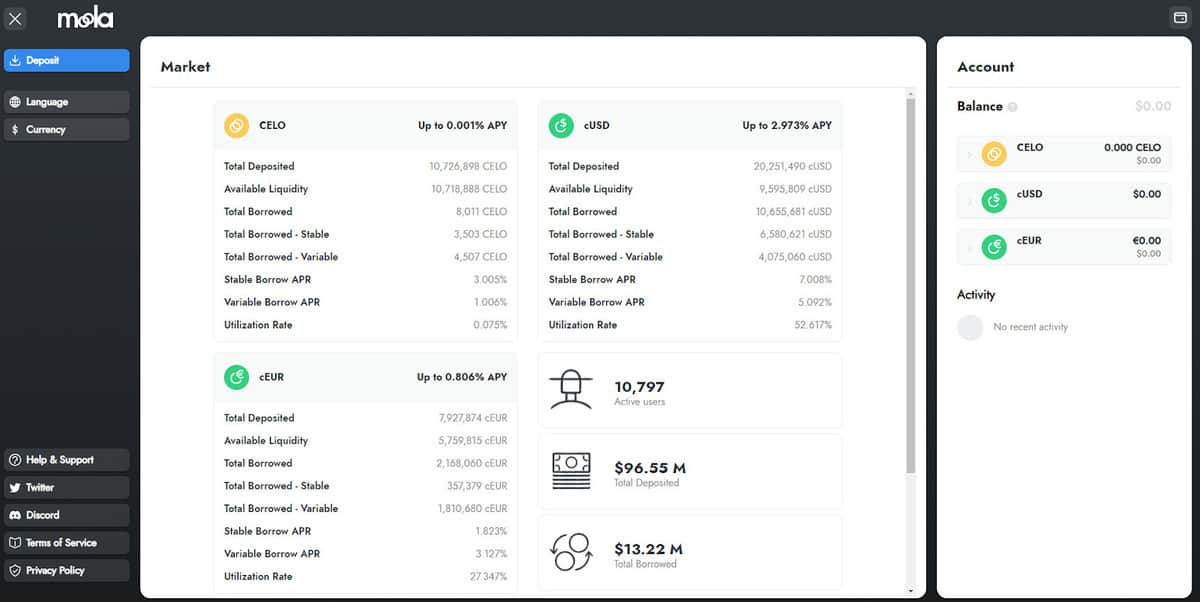

Moola currently supports 3 crypto assets: #

- Celo: The native asset of the Celo platform.

- Celo Dollars (cUSD): A stable asset that follows the US Dollar price.

- Celo Euro (cEUR): Algorithmically follows the price of the Euro currency.

Web App of Moola: https://app.moola.market/#/

Moola’s main function is to allow you to borrow any amount of assets from its liquidity pools without putting up any collateral, as long as the borrowed liquidity plus a flash loan fee is returned to the pool within the same block.

Flash loans have a short life cycle, so everything has to happen within that short time frame before it expires like a flashlight.

You can get a lot of cash fast with a flash loan. This can help in a lot of situations, including arbitrage trading, swapping collateral, debt refinancing, etc.

An arbitrage trade uses price differences between exchanges like Ubeswap and Mento. Financial markets rely on this. Arbitrage helps the market follow supply and demand to maintain the Celo ecosystem’s value. Like this:

- If you find that the Celo price on Ubeswap is higher than the Celo price on Moola, the Celo price on Ubeswap would be $101, while the Celo price on Moola would be $100. So you’ll borrow 1 Celo in Moola using Flash loans.

- Once you have transferred Celo to Ubeswap for $101, your profit will be $1.

- By increasing the supply of Celo in Ubeswap, you’ve helped lower the price, similar to increasing demand in Moola, which drives up the price of Celo there. This transaction is called arbitrage, which helps to close the price gap between the two platforms.

What is the MOO token? #

The Moola Market token is called MOO. They will distribute the MOO token to network participants like liquidity providers, developers, early users, and others who help Moola, Uberswap, and Valora succeed.

MOO Key Metrics #

- Token Name: Moola Market.

- Ticker: MOO.

- Blockchain: Celo.

- Token Standard: cERC-20.

- Contract: 0x17700282592D6917F6A73D0bF8AcCf4D578c131e

- Token Type: Utility, Governance.

- Total Supply: 100,000,000.

- Circulating Supply: Updating…

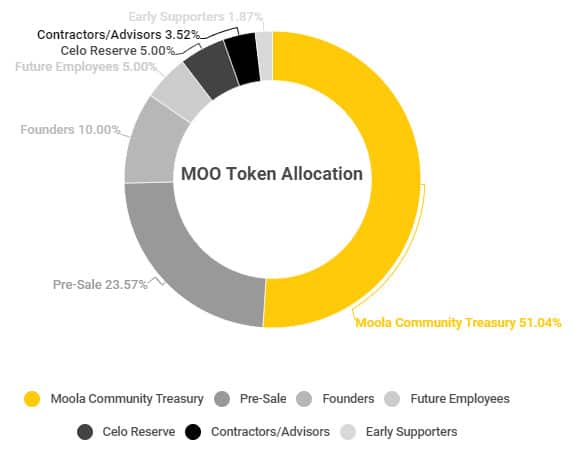

MOO Token Allocation #

- Moola Community Treasury: 51.04%.

- Pre-Sale: 23.57%.

- Founders: 10%.

- Future Employees: 5%.

- Celo Reserve: 5%.

- Contractors/Advisors: 3.52%.

- Early Supporters: 1.87%.

Token Allocation of Moola Market

MOO Token Use Cases

Governance: Active stakeholders and liquidity providers are engaged in the process of discussing, voting for protocol upgrades.

You can stake MOO on Ubeswap pools to get transaction fees and incentives in MOO tokens.

How to get MOO Token

Ubeswap allows you to buy MOO tokens and stake them in pools in order to receive incentives for MOO tokens.

How to store MOO Token

You can store MOO tokens in wallets on the Celo ecosystem.

MOO Roadmap

Moola has now developed a minimum viable product (MVP) on the web version.

The community doesn’t have access to Moola’s roadmaps. I think Moola’s next step is to develop mobile apps and connect with a lot of Defi ecosystems outside of Celo.

Team

Patrick Baron (Founder of Moola Market): He worked as the Managing Member of Validator Capital in 2020. Then, he founded Moola in 2021.

Investors

Crowdfunding round of $1.4m for Moola. Among its backers are Polychain Capital, Flori Ventures, and Davoa Capital.

Is Moola (MOO) a good investment? #

Celo’s ecosystem aims to bring DeFi to over 6 billion smartphones. Moola aims to do the same. Moola can grow in the future if it uses the network effect in the Celo ecosystem. (Not Financial Advice)

Total Value Locked of Moola (updated: October 10th, 2021) – Source: Defi Llama

In the last three months, Moola’s Total Value Locked (TVL) has grown 10,000% to about $80 million. Even so, Moola’s TVL is still low compared to the top platforms.

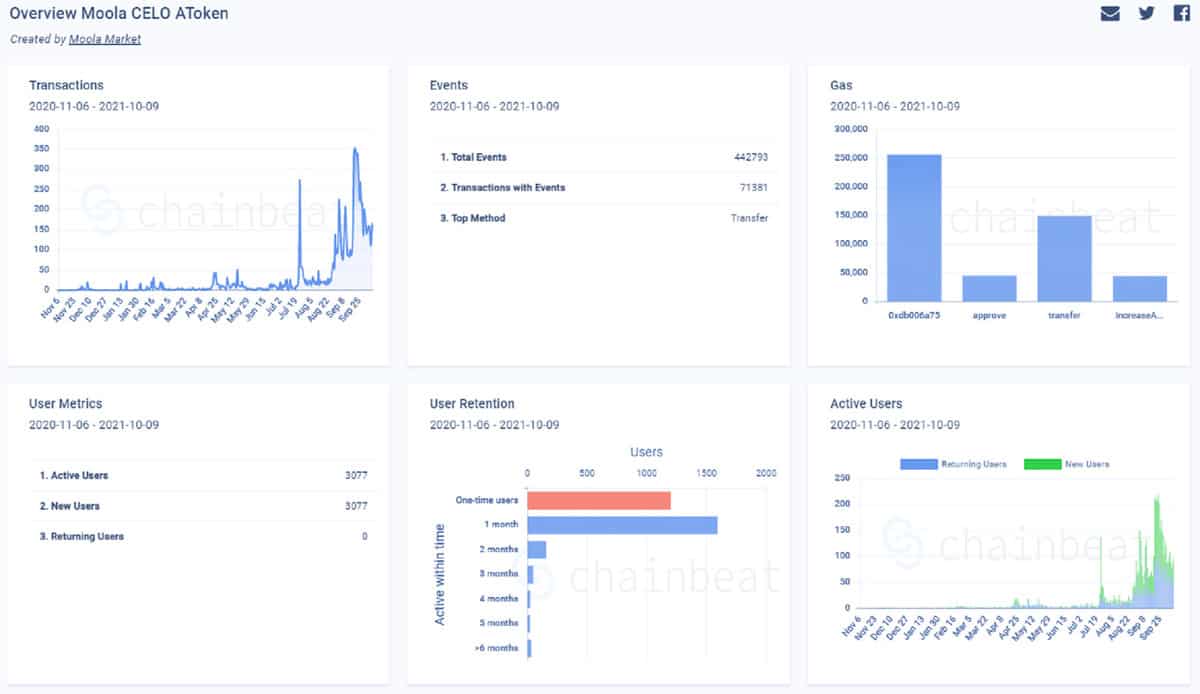

Updated key metrics for Moola (October 10th, 2021) – Source: Chainbeat

According to Chainbeat, the number of Moola transactions per day is still quite low, and volatility is pretty high. Clients who have only been using the service for a month make up most of the current users. All the old files are gone. In my opinion, Moola is still a risky investment. Again this is not Financial Advice.

Conclusion #

Moola is one of the Celo ecosystem’s first Lending & Borrowing projects, so Moola has the advantage of being a pioneer compared to other competitors in the same ecosystem.