In this guide we will show you how to use Moola’s Money Market to:

- Place a deposit (cUSD or CELO).

- Take out a loan (cUSD or CELO).

- Pay it off.

- Redeem our collateral.

Moola is a decentralized money market protocol on the Celo blockchain. Moola, a fork of Aave protocol v1, allows liquidity providers to earn compound interest on their Celo Dollars(cUSD) or CELOA, which is paid by borrowers who can get a collateralized loan with a variable or stable interest rate.

We need a wallet that we can use to use Moola. We’ll be using the Valora app, which is a custodial wallet with a beautiful UI where we can store our Celo and cUSD.

Requirements #

- Valora App

- Funds to use as collateral on Moola.

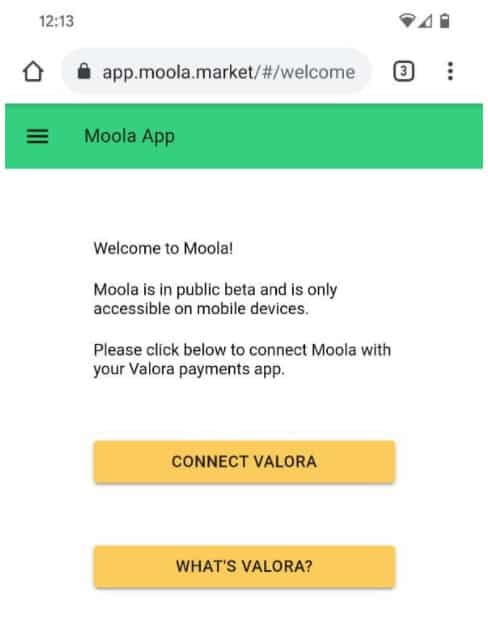

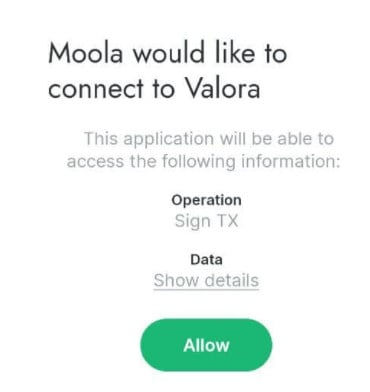

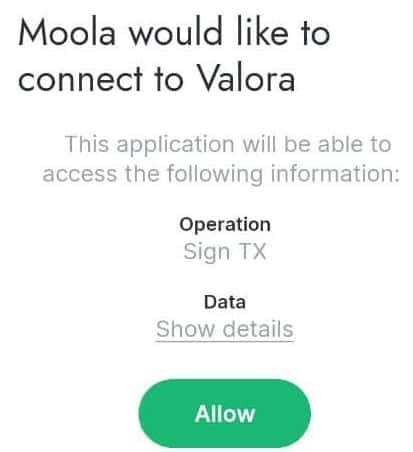

Connecting Valora with Moola #

We need to head over to Moola after we set up our Valora. You’ll see something like this:

Click on Connect Valora button and then press Allow.

Now Moola has view access to our funds which we have deposited on Valora App.

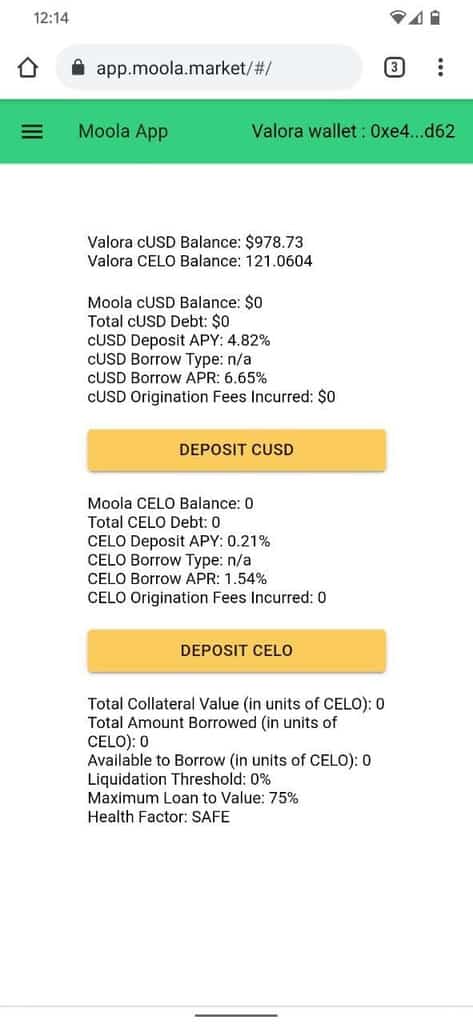

We can deposit cUSD or CELO using the Valora app and start earning interest. Rates adjust based on demand. Rates are low when demand for the asset is low. Rates are high when demand for the asset is high.

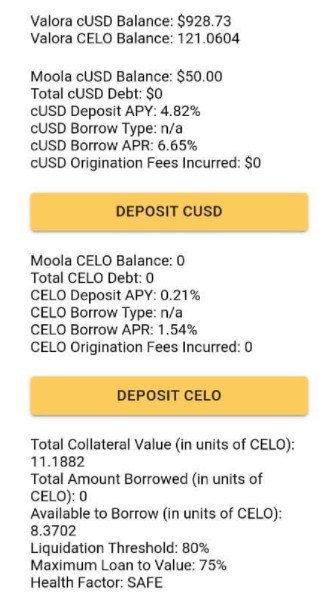

Now there are a couple of things to give attention to:

1. Deposit APY (annual percentage yield) – This is the interest you’ll get if you put money up.

2. Borrow APR(Annual Percentage Rate) – What you pay each year to borrow money.

3. This is the amount a user can borrow by putting down collateral. If you deposit 100 cUSD, you can borrow 75 cUSD or Celo of equivalent worth against it. Just remember there’s interest.

4. Liquidation Threshold (80%) – Moola always check that users have healthy LTV (loan-to-value). Let’s say a user deposited $100 in Celo and borrowed $75 in CUSD. Now Celo is worth less than $100. That means LTV is over 75%. Moola won’t accept this and will have to liquidate the user. If the LTV ratio falls below the Liquidation Threshold (80%), then some of the collateral can be sold at a discount to get the LTV back to below 75%. You can put up more collateral to avoid being liquidated.

5. Health Factor – This indicates the health of the user’s loan. It should always be safe.

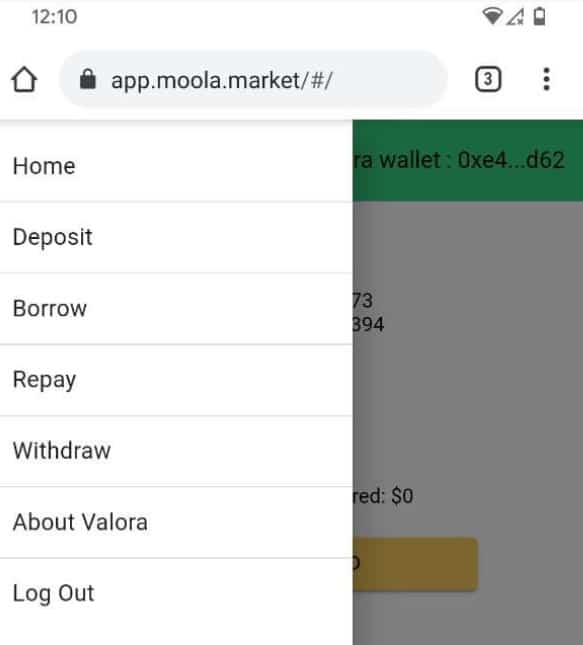

A Quick Guide to Moola #

Moola offers various functionalities which can be seen here.

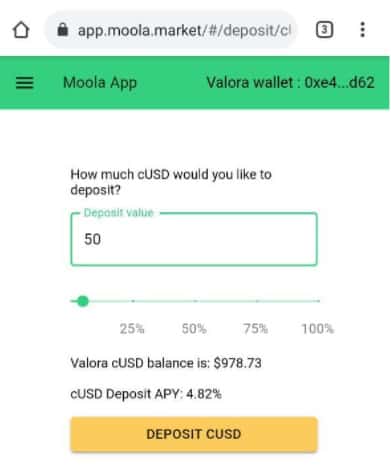

Deposit #

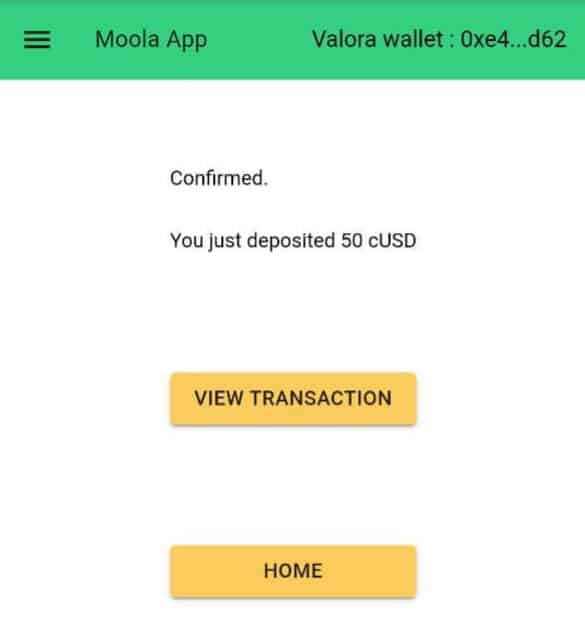

Let’s start by putting 50 USD into Moola. Just click Deposit and enter the amount.

Click on Deposit cUSD.

Sign the transaction by using Allow.

We got our transaction confirmed.

Now our home screen should look something like this:

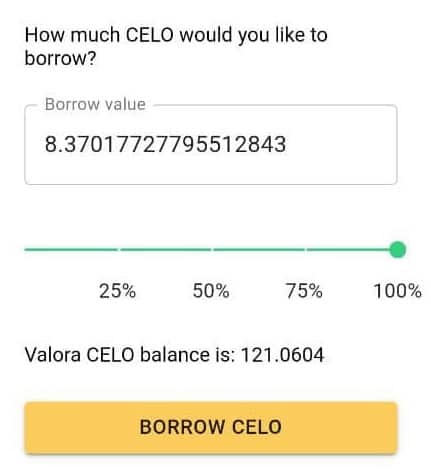

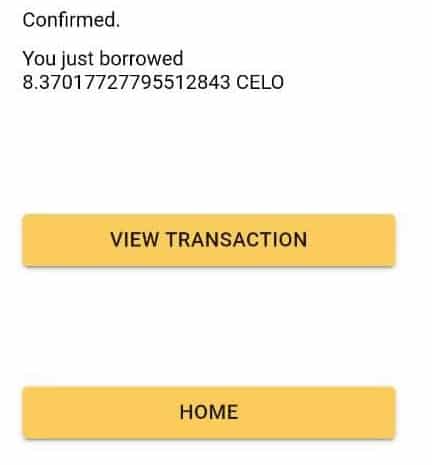

Borrowing #

Let’s borrow some Celo from the Borrow tab.

Then Sign the transaction.

Now our Transaction got confirmed.

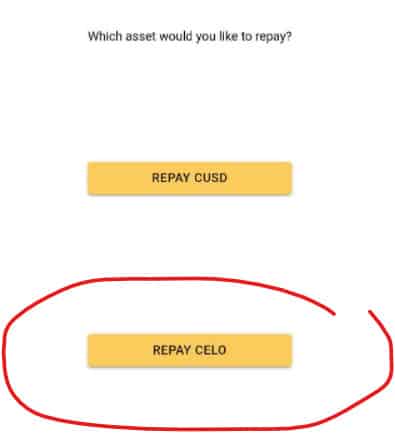

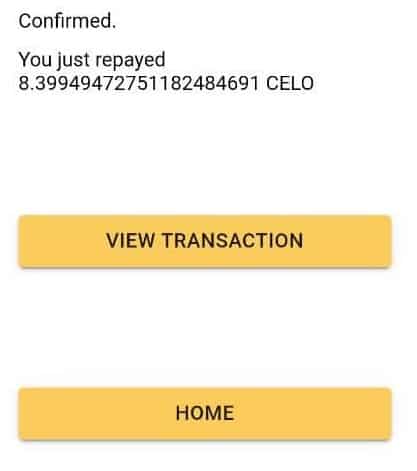

Repaying Loans #

To get our deposited CUSD, we have to repay the Celo. Click on the Repay tab and then “Repay Celo”.

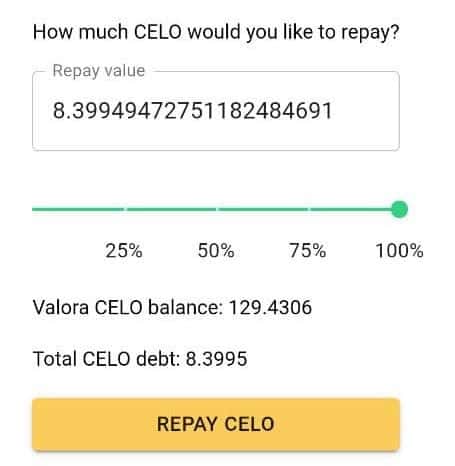

Enter the amount, for this case, we will repay all our debt.

Click on Repay Celo.

Our transaction got confirmed.

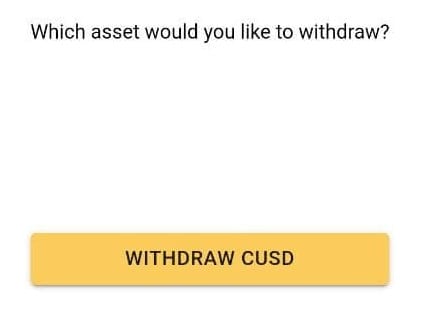

Withdrawals #

Now that we’ve paid off our debt, we can withdraw our cUSD. So let’s send our cUSD to Valora.

On the Withdraw tab, click Withdraw CUSD.

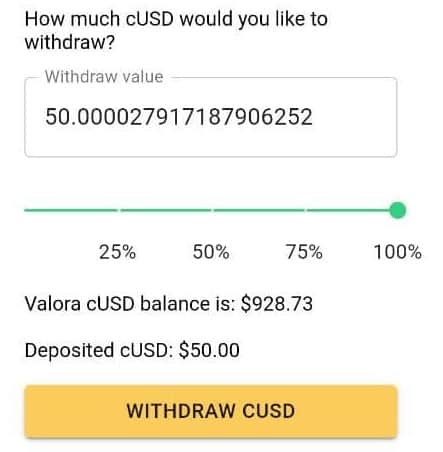

Let’s cash out all our cUSD. We can see that Moola has already added the interest that accumulated while our cUSD was deposited. Type in the amount and click Withdraw CUSD.

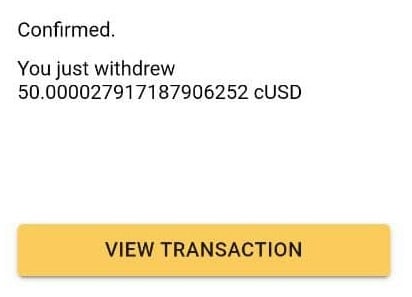

We got our transaction confirmed.

That’s it for this guide!

You should now be able to use Moola and participate in DeFi on Celo blockchain.