The Celo blockchain ecosystem has been silently and steadily growing in 2021. This blockchain now holds more than $600M in cryptocurrency assets. Most of that liquidity has gone to Mento, which is the “flagship” dex on Celo but others like CeloDex are attracting attention as well.

What Is CeloDex? #

CeloDex is an automated market maker (AMM) which is developed and managed by the same team behind PolyDex. The exchange itself doesn’t bring anything revolutionary to the table but it does have interesting farming mechanics.

Most of the rewards are locked long-term with the goal to maintain price but also bring long-term value to token holders and farmers.

Token : CeloDEX ($CLX)

Token Contract : 0xC7144Fa865c9f3a6836167A51531A2CC8b0ab5fD

Maximum Supply : 100,000,000

Initial Price : 0.2$

Distribution allocation #

Developer Fund : 10% | 10,000,000 $CLX

Marketing Fund : 10% | 10,000,000 $CLX

Treasury : 5% | 5,000,000 $CLX

Main Reserve for Polygon PLX holder : 10% | 10,000,000 $CLX

Liquidity Incentives (Farming) : 44.5% | 44,500,000 $CLX

Vault Incentives : 20% | 20,000,000 $CLX

Initial Liquidity : 0.5% | 500,000 $CLX

How To Use CeloDex? #

To start using CeloDex you will need a Metamask wallet with Celo network added to it. From the dropdown menu in your Metamask wallet click on “Add Network” and enter the following information:

Network Name: Celo (Mainnet)

New RPC URL: https://forno.celo.org

Chain ID: 42220

Currency Symbol (Optional): CELO

Block Explorer URL (Optional): https://explorer.celo.org

Click “save” and the Celo network will be ready to use.

To get started you will need some Celo tokens to pay for the gas fees. The easiest way to acquire some is through a centralized exchange, fiat onramp, bridging funds from other networks or a Celo faucet.

When you have enough Celo to pay for the fees and enough capital to start farming you can go to CeloDex and select the farm of your choice.

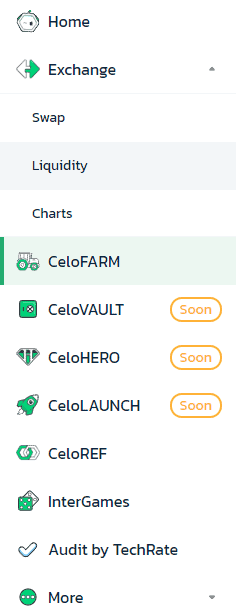

If you select the CLX-CELO farm for example, you will need to add liquidity to the CLX-CELO pair on the dex. This can be done by clicking on “Exchange” and then on “Liquidity”.

Liquidity pools require deposits to be at a 50/50 ratio so your CLX USD value will need to be matched with the same USD value of Celo. Once the deposit is made you will receive LP tokens that serve as a receipt of your deposit. You will need to deposit these LP tokens into the farming corresponding farming contract to start receiving the rewards, in this case that would be the CLX-CELO farm.

Unlock your wallet, approve the farming contract and after that you will be able to deposit the LP tokens. It is important to know that CeloDex has lockup periods that are displayed at the top of every farm. A 30-day lockup period would mean that you can’t remove the LP tokens before 30 days have passed since the deposit. This also locks your liquidity because you will not be able to remove it without the LP tokens so plan accordingly.

Farm rewards are also locked for a certain period of time. Only 30% of the rewards will be available while the rest will be locked for one year and vested after the 1-year period has passed.

More information on lockups and upcoming features can be found on the CeloDex Medium page.

Risks Involved #

As with every DEX and AMM there are some risks involved in the process. Price fluctuations pose a risk of impermanent loss while locked rewards can make your farming efforts obsolete if the price of the native token keeps declining.

Contracts are audited but that is never a guarantee of safety. Doing your own research before using CeloDex and their products is always highly advised.

Conclusión #

The Celo ecosystem is still growing and CeloDex is one of few decentralized exchanges that offer farming on this blockchain. Those that are looking for passive income may find it interesting but as mentioned above, certain risks have to be considered beforehand.