xDAI is widely considered as an incentivized testnet for Ethereum because of the early adoption of EVM compatibility and low transaction fees. It stands out of the crowd because the native currency is xDAI, a stablecoin that has a predictable price which guarantees cheap transactions in all market conditions.

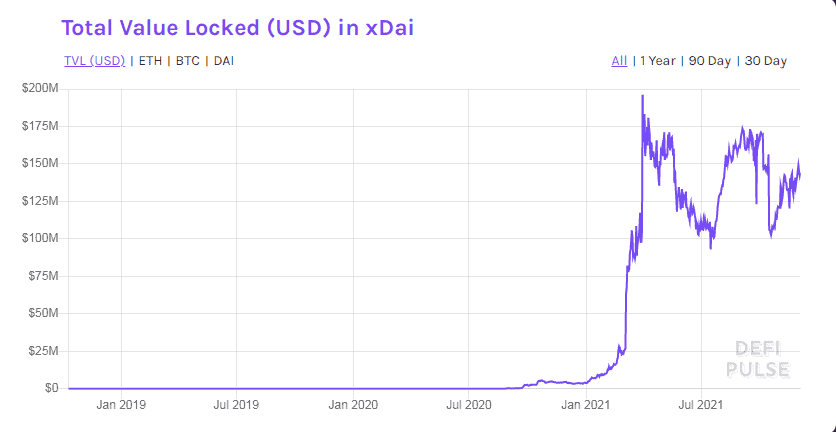

The network started attracting liquidity in 2021 when yield farming was introduced. TVL peaked at about $200M and more farming opportunities have kept emerging ever since.

Metamask Setup #

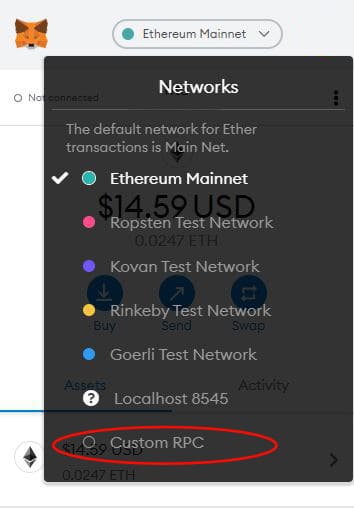

xDAI will need to be added as a new network. From the dropdown menu select “Custom RPC” or “Add Network” and enter the following information:

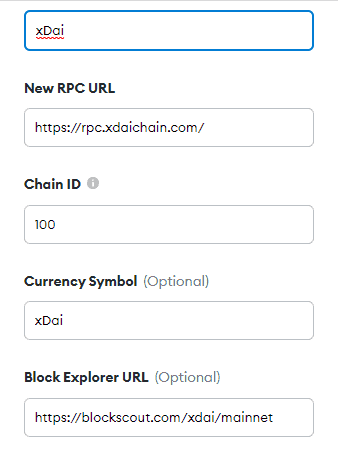

Network Name: xDai

New RPC URL: https://rpc.xdaichain.com/

Chain ID: 100

Symbol: xDai

Block Explorer URL: xDai (xDAI) Explorer

Click on the “save” button and xDai will be added to your Metamask wallet.

Funding Your Wallet #

Centralized exchanges won’t be of use for xDAI because none of them offer direct withdrawals to this network. The only two ways users can get capital on the xDAI chain is through fiat onramps and bridging.

A detailed explanation on how to purchase xDAI with fiat can be found aquí. Credit card purchases are processed via Ramp Network and deposited directly to your Metamask wallet address.

The other solution would be bridging. Xpollinate and Hop Protocol are just a few bridges that will allow users to send funds from other networks to xDAI. Even though there is no way to send the native currency from other networks you can still send currencies like Ethereum and Bitcoin to convert them afterwards. The swap will require some xDAI but there are a few faucets that can get you started right away with some free xDAI.

Farming #

As always, Vfat tools is a great way to explore the farming opportunities on xDAI but it is worth mentioning that it doesn’t cover every farm out there. Most of the farms have to be found through social media announcements or forum posts so those that are really curious will need to follow at least one social media channel.

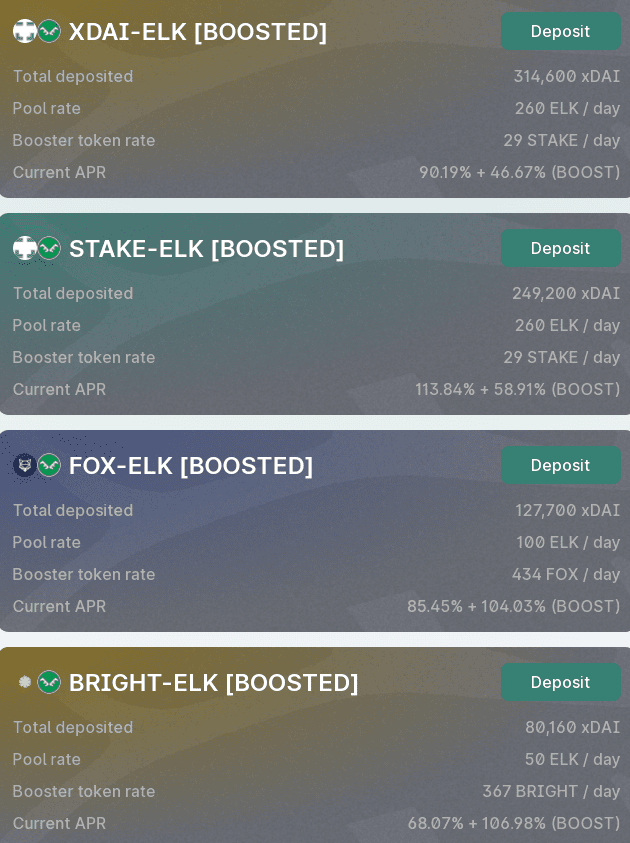

The most popular choice for farmers right now is Elk Finance, which we can also use as an example.

If you click on “Farm” you will see all of the expected returns for every pair offered by this dex.

If, for example, you chose the XDAI/ELK pair you will need the same USD value of both currencies in your wallet before making a deposit. Liquidity pools require a 50/50 ratio at the moment of deposit, so if you want to deposit 50 xDAI you will also need 50 USD worth of ELK.

Go to the “Pool” tab, click on “Add Liqidity” and once the transaction is confirmed the protocol will issue LP tokens to your address. These tokens represent the tokens you have staked in the pool and serve as a receipt that you can use to withdraw your funds at any moment.

To start farming you will simply deposit the LP tokens in the corresponding farm. In this case that would be XDAI/ELK. Once the LP tokens are deposited the rewards will start accumulating according to the APR percentage for your farm.

The same process applies for every other pair and farm.

Conclusión #

xDAI does not have a huge number of farms like many other chains but it can still serve as a starting point or training ground for beginners. Cheap transactions will allow users to make mistakes with no penalty due to high gas fees.

And while cheap transaction fees are a benefit, the same risks apply as on any other chain. Users that provide liquidity on farms will always be exposed to the risk of impermanent loss and no one can guarantee the safety of their funds. Doing your own research is always highly recommended.