You might have taken a closer look into Decentralized Finance (DeFi) farming- and liquidity pools, only to become more confused by all the different type of token rewards per pool. The purpose of this DeFi Farm 102 guide is to explain the differences between native and non-native tokens.

Native and Non-Native tokens #

Typically, DeFi yield farming platforms reward and incentivize farm and pool investors with their governance token. For example, Binance Smart Chain’s Pancakeswap rewards their investors with additional CAKE tokens, on top of the earned trading fees for a specific pool.

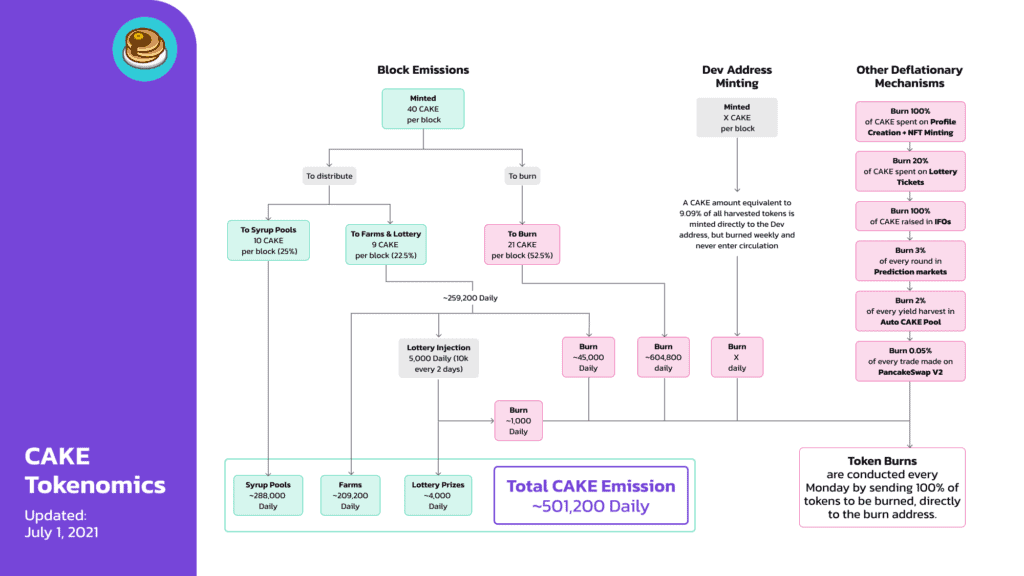

In this example is the CAKE token the native token of Pancakeswap. The CAKE rewards for their Syrup Pools come from the CAKE emissions. For each block, a number of CAKE tokens are allocated as rewards for these pools. The remaining CAKE tokens are distributed over their farms and lottery.

DeFi platforms often reward investors with other tokens. For example, Rather than rewarding it’s investors with CAKE, Pancakeswap rewards them with a different token such as AMPLE. The AMPLE token is the governance token of a different DeFi platform, in this case Ampleforth. This makes the AMPLE token for Pancakeswap a non-native token.

The rewards for the “Stake CAKE, earn non-native tokens” Syrup pools are provided by the project teams who sponsor the Syrup Pools. By providing attractive APRs, new investors are incentivized to provide liquidity to the trading-pool, which helps new DeFi projects to become more popular amongst investors.

A variant on Pancakeswap’s Syrup Pools are Sushiswap’s ONSEN Pools. The key difference is that Sushiswap rewards the investors with their native token SUSHI, rather than having the DeFi project reward the investors with their own governance token.

Popular DeFi protocols such as Pancakeswap also often have another promotion feature for non-native tokens which is called “Initial Farm Offering” (IFO). IFOs let investors get early access to new non-native tokens as soon as they are added to the platform. By being one of the first to have such a new token, investors can benefit from higher rewards.

Native and Non-Native token Farms and Pools: The Pros and Cons #

Native and non-native tokens farms and liquidity pools both have their own pros and cons. For example, native tokens often have lower APYs than non-native tokens, but (well established) native tokens are also typically less volatile than non-native tokens from new DeFi projects.

Non-native tokens on the other hand usually incentive investors to provide liquidity to their pools by rewarding them with high APYs. However, due to these projects being typically relatively new, their tokens are very volatile and can tank in price when the market goes down. Another risk is that because these projects are new, there’s no certainty that they will turn into successful platforms.

Conclusión #

New (Non-native) tokens are typically introduced to investors via popular DeFi platforms such as Pancakeswap and Sushiswap. By providing attractive APYs new investors are incentivized to provide liquidity in such pools, resulting in making the new project more popular amongst investors. However, non-native tokens tend to be more volatile than native tokens and can therefore generate both high profits and losses. It is wise to be careful with such tokens: don’t invest more than you’re willing to lose.