PolyTrade (TRADE) wants to change the future of our financial world with their DeFi platform. On this platform, they offer a system that can pay invoices instantly, fully automatically with stablecoins. In this way parties that send an invoice, no longer have to wait weeks or months for the invoice to be paid. PolyTrade ensures that their users receive their money immediately.

What is PolyTrade (TRADE)? #

PolyTrade can be seen as a bridge between DeFi (Decentralized Finance) and TradFi (Traditional Finance). Do you have a business? Then unfortunately you have had to deal with people who pay their invoices late or not. Even if you don’t have a business, you can probably imagine this problem occurring. Luckily, business owners can now use PolyTrade.

Tokenization of invoices #

On the PolyTrade platform, companies can tokenize invoices. This means that they convert their invoice into a unique token that runs on the blockchain. In this case, non-fungible tokens, or NFTs, are used. These are tokens that are distinguishable from each other because they have a unique character trait.

NFTs are ideal for tokenizing these bills. This is because each invoice is unique and should be treated as a separate case. By tokenizing an invoice, a real-world invoice can be converted to an on-chain invoice.

Paying invoices with yield farming #

As a paying party, you can go with the selling party to PolyTrade (or vice versa). As a buying party you can build up credit with PolyTrade. By doing so, it is not necessary to pay an invoice immediately, giving you the option to leave it open. However, the selling party immediately receives his money. This money comes from PolyTrade’s liquidity pool.

Users can provide liquidity to the liquidity pool to pay the invoices of selling parties directly. As rewards, these liquidity providers receive an interest in the form of stablecoins, and TRADE tokens. TRADE is a reward token for everyone who uses PolyTrade.

If you want to earn a return on your crypto, PolyTrade is an ideal platform. How high the interest is varying per moment and per invoice.

User and credit check #

To build up a credit, you must first secure collateral. Also, the creditworthiness of a buying party can be checked by members of the community. They receive rewards in the form of TRADE tokens when they take on these types of tasks. Because a check is carried out, all parties involved run less risk.

Investing in companies #

Crypto traders get the opportunity to invest in real-world assets at PolyTrade. When you want to start a business, you obviously need money. Unfortunately, it is difficult to raise money. That’s why PolyTrade wants to help these start-ups get off the ground.

When companies are given the space to pay their invoices at a later stage, they can invest more money in building their business. This ensures that companies can develop themselves faster and more easily. At the same time, the crypto lending users don’t have to worry about their investment because collateral is secured.

Partners and investors #

PolyTrade has entered into various partnerships in recent years. These include Certik, Immune Bytes, Parsiq, Polygon, Biconomy, Transak, AHRVO, Fractal, Venly, WalletConnect and MetaMask.

Then there are also several large parties that have invested in PolyTrade. They believe in the future of this project and on that basis have decided to make a financial contribution to PolyTrade. Major investors include Dfyn, Ethdesign Capital, AXIA8, AU21 Capital, Icetea Labs, Krypital Group, Master Ventures, LD Capital, M6, Orion, Polygon, Router, Rok Capital, Shima Capital, Spark Digital Capital and HG Ventures.

How does PolyTrade work? #

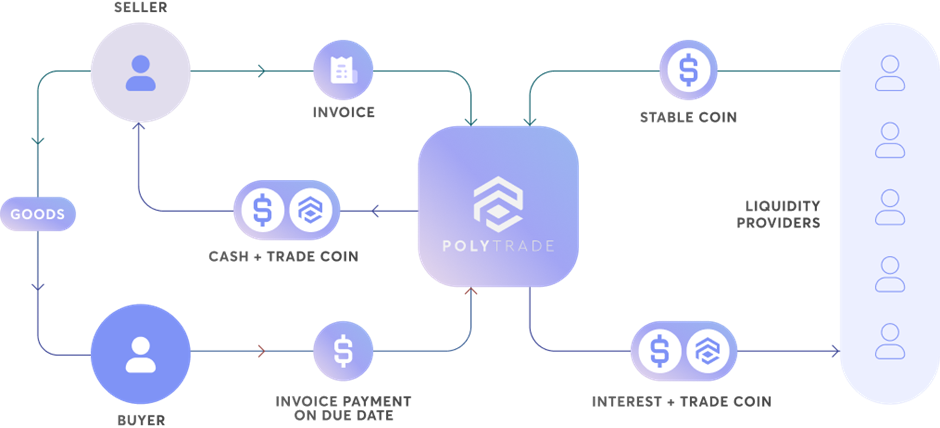

Below you can see through an illustration how PolyTrade actually works. On the right we see the liquidity providers that lend stablecoins. Companies can post their invoices on PolyTrade and are paid with stablecoins. The buying party pays the invoice to the liquidity pool with stablecoins.

TRADE tokens #

TRADE is the token of PolyTrade, which has a maximum supply of 100 billion. Not all tokens have been issued yet. At the time of writing, September 2022, only 12% has been spent. This means that there are about 12 billion tokens in circulation. But what are these TRADE tokens all good for?

- Governance features – TRADE allows you to vote on what the future of the platform should look like. This means that not only the platform itself, but also the board, works completely decentralized.

- Earning staking rewards – When you lend crypto to the pool, you will not only receive rewards in the form of stablecoins, but you will also receive TRADE tokens. This makes PolyTrade an ideal platform for yield farming.

- Lower Fees – When you borrow money and want to pay the bill, you pay lower fees when you make the payment with TRADE tokens. Even when you place an invoice on PolyTrade, you can pay the costs with TRADE tokens to receive an extra discount.

- Task Reward – It is possible to earn TRADE tokens when you complete important tasks for the platform. This includes validating documents, checking creditworthiness, and performing KYC (Know Your Customer) tasks.

The pros and cons of PolyTrade #

Now that you’ve read what PolyTrade is and how it works, you may have an idea of the main benefits of this project. To briefly summarize what PolyTrade is, we will list the main advantages and disadvantages of PolyTrade for you.

Pros #

- It is possible to upload any invoice on PolyTrade. So, no minimum value is set, making PolyTrade a solution for both large and small companies. This makes PolyTrade widely applicable within the market.

- Low costs are charged on the platform, so that there is no financial barrier for companies.

- The platform can quickly process invoices and transactions. This ensures that companies can be helped quickly, and investors can use the platform efficiently.

- Investors are given the option to invest in invoices, completely digitally. Everything is done through smart contracts, so there is no need to set up a lot of paperwork.

- The invoices are insured and covered, so that you as an investor run a small to no risk.

- The platform runs on the blockchain and is therefore secured by the decentralized network and cryptography. This ensures that data and crypto of users, provided they keep their private keys safe, cannot be leaked.

Cons #

- As an investor or user, you always run the risk of losing your stake, because everything works on smart contracts. These are digital contracts that run fully automatically on the decentralized network of the blockchain. There is always a chance that something will go wrong with the smart contract. In that case, you have nowhere to go, because everything is decentralized.

- PolyTrade is still new and not widely used. This means that the project has yet to prove itself. Despite the fact that the project appears to be strong at first glance, in reality it remains to be seen whether the project will get off the ground and catch on.

- Difficult to understand. It is difficult to understand how PolyTrade works. This is not necessarily a bad thing for you, but it can be disadvantageous for potential users. Companies will not start using the platform if they take a long time or take a lot of effort to understand how the platform works. That is why it is extra important for PolyTrade to explain the operation and services they provide in the simplest possible way.

Conclusion #

PolyTrade is an interesting project with a unique view on paying invoices. Companies, both large and small, can have a lot of problems with customers not paying their invoices. Now it is possible to tokenize the invoice on the PolyTrade platform. Investors then have the option to provide tokens with which invoices can be paid. If they do this, they will receive interest (in the form of stablecoins) and TRADE tokens as a reward.

This makes PolyTrade not only a suitable platform for paying invoices. This also makes PolyTrade suitable for yield farming, which more and more crypto traders are using.

Despite PolyTrade appearing to be a promising project, we should not forget that the platform is new and has yet to prove itself. It runs completely decentralized, which can cause problems.