In terms of networking systems, blockchains are introverts. Developers and users alike face a challenge due to their inability to access users and apps outside of their native ecosystems. We don’t need to wait for Satoshi and Buterin to upgrade the mainnet; a third-party solution called Wormhole already exists.

Wormhole is the latest bridging protocol to be launched in 2021. It is a cross-chain tool that connects high-value blockchains, including Ethereum, Solana, Terra, Binance Smart Chain, and Polygon. A growing demand for quick and cheap asset transfers between different crypto ecosystems has propelled its growth. Wormhole reached a TVL of $850 million in five months due to the demand for high-quality bridge products.

The Wormhole protocol is a generic messaging protocol that interacts with different blockchains. Smart contracts emit messages through its network, which are sent to a target destination – forming a cross-chain bridge.

Wormhole’s design allows it to transport data faster, cheaper, and more securely than any other bridging service. Aside from the existing crypto and NFT bridge apps, developers can also build products on top of Wormhole.

The Bridging #

A bridging protocol is an application that creates a virtual bridge between two blockchain networks, allowing them to communicate. By communicating, we mean the transfer of any information, including the transfer of assets.

Currently, the market is like a vast neural network filled with fantastic ideas and concepts. The AVAX yield farm has low network costs and a high yield, while the Solana NFT mining environment is chaos-free, with cheap transfers, and Ethereum has many high-market-cap altcoins to choose from. There are no synapses in this neural network to connect these various locations.

In the event that an attractive yield farming protocol launches on AVAX, Ethereum investors will not be able to relocate and repurpose their capital in a fast, cheap, and easy way. It is especially impossible to do that decentralized. Ether is most often transferred from non-custodial wallets like Metamask to a centralized exchange, where it is exchanged for another token and then withdrawn to a wallet on another network.

The process is long. Then you realize how tiresome the whole process is when you consider all the 2FAs and email codes required to execute these withdrawals.

We can save ourselves with bridge protocols. Decentralization eliminates the need for exchanges since all of them are decentralized. Decentralized exchanges may have the same impact-level as bridge protocols on DeFi.

Introduction to Wormhole #

Wormhole uses cross-chain messaging to connect high-value blockchain networks in August 2021. A network of Guardians protects Wormhole from malicious actors and hacking attempts.

Events and transactions on Wormhole are observed and attested by guardians. Entities connected to Wormhole are able to access these attestations and can track the flow of money between various chains.

Over two-thirds of the Wormhole’s Guardians must attest to the ledger’s state in order for consensus to be reached.

As soon as it is created, the attestation is sent to the targeted blockchain to execute the transaction and trigger smart contract code, if present. The process can be compared to miners verifying transactions.

Wormhole is efficient and secure because of several key factors, according to the team. Among them are:

- Fully generic network

- Consensus abstraction

- Speed

- Upgradability

As a fully generic network, Wormhole allows its cross-chain messages to contain abstract data. Developers can create applications on top of Wormhole, including governance, decentralized oracles, NFTs, and asset transfers.

The consensus abstraction in Wormhole refers to a lightweight consensus process that can be completed asynchronously over the peer-to-peer network. Consequently, transactions have a high throughput. Wormhole can also relay signed messages to another chain connected. Additionally, the chain can also execute custom logic if present.

Low latency is another benefit of Wormhole’s speed. Its asynchronous single-round consensus design enables it to transfer information quickly to any blockchain. According to the team, their network is almost on par with Solana’s high TPS count.

And last but not least, Wormhole can be fully extended and upgraded. An easy governance process allows the network to connect to new chains. As long as a supermajority is met, the protocol’s main contracts can also be upgraded.

Guardian Network #

Most of the Guardian network’s node operators and validators are reputable staking services with established track records. There are 19 Guardians in total, including:

Wormhole: Why Use It? #

Wormhole’s main product is a bridge application built on top of its messaging network. Users can send assets between Ethereum, Solana, Terra, Binance Smart Chain, and Polygon using the app. A user can exchange a Wormhole wrapped asset on various markets after sending tokens between chains. In addition to standard cryptocurrencies, users can send non-fungible tokens.

Wormholes are highly liquid. The protocol has reached a TVL (total value locked) of nearly one billion dollars after nearly five months of operation. Terra and Ethereum account for the majority of capital. Binance Smart Chain (BSC) integration and FTX integration significantly contributed to the success of this bridging product.

Money processing seems like a difficult task for Wormhole, but it is not. All 19 Guardians constantly broadcast messages and facilitate token transfers. Furthermore, all nodes support all Wormhole networks. On average, the protocol processes 1300 transactions per day, according to their explorer.

How to Use Wormhole #

Check out Wormhole bridging app at the following link.

Choose your source chain and target chain first. You withdraw assets from the source chain. You receive assets from the target chain. If you want to continue, you must have a wallet for both chains on your web browser.

Connect your wallet and choose the token you wish to move after you select the two networks. You will receive a list of tokens after selecting an asset. There are a number of tokens and dApps where your token is liquid in this list. One of the only liquid markets for SOL is Uniswap, according to Wormhole.

There is no liquidity pool assigned to tokens listed under ‘Other Assets’. They are useless since there is no liquidity. Bridge only assets with corresponding liquidity pools. Make sure the LP is large enough.

Once you have selected a wallet for your target chain, set the amount you wish to transfer. Connect your wallet to the Wormhole app and grant access.

Once you have hit ‘next’, click on ‘transfer’ to continue. Next, confirm the transfer.

Wait for the transfer to be completed. Then you can redeem your newly wrapped tokens and complete the bridging process.

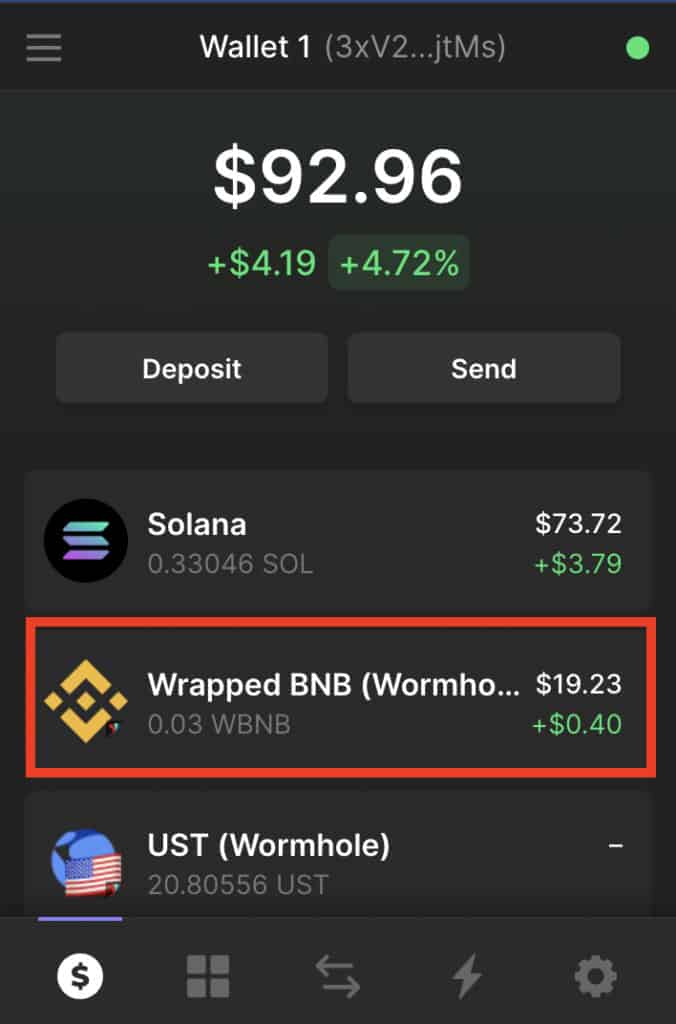

An example of an asset wrapped around a wormhole.

An example of an asset wrapped around a wormhole.Conclusion: #

In the Wormhole protocol, any type of data can be passed between different networks, allowing blockchains to communicate with each other. The bridging is subject to adapt and confront change as there is a version 2 (V2) on the way. That will be covered as time continues. But the foundation stays as is.

References: #

Wormhole Token Bridge. (2021, January 1). Wormhole. https://wormholebridge.com/#/